Courier, Express and Parcel Services Market Size, 2032 Report

Courier, Express and Parcel Services Market Size

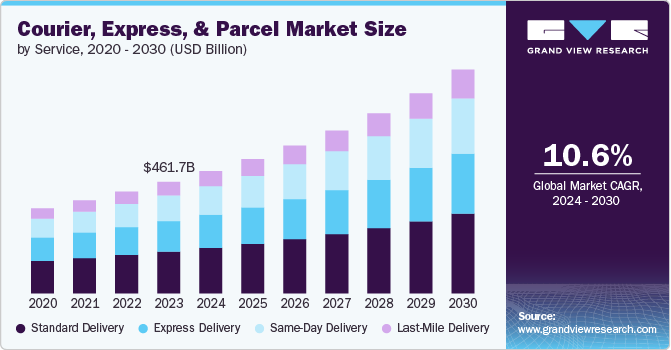

Courier, Express and Parcel Services Market size was valued at USD 433.6 billion in 2023 and is projected to grow at a CAGR of over 7.2% between 2024 and 2032. The expansion of e-commerce and online shopping significantly drives the growth of the market. As more consumers shop online, the demand for fast and reliable delivery services has increased substantially among merchants.

Efficient logistics solutions are essential to handle the high volumes of parcels and ensure timely deliveries in the e-commerce sector. This surge in demand highlights the importance of CEP services in managing and expediting shipments from sellers to buyers. Additionally, the emphasis on enhanced tracking and customer service by e-commerce platforms compel providers to innovate and expand their capabilities. Overall, the growth in online shopping increases parcel volumes and creates greater revenue opportunities for CEP companies.

| Report Attribute | Details |

|---|---|

| Base Year: | 2023 |

| Courier, Express and Parcel Services Market Size in 2023: | USD 433.6 Billion |

| Forecast Period: | 2024-2032 |

| Forecast Period 2024-2032 CAGR: | 7.2% |

| 2032 Value Projection: | USD 802.1 Billion |

| Historical Data for: | 2021-2023 |

| No. of Pages: | 252 |

| Tables, Charts & Figures: | 259 |

| Segments covered: | Service, Transportation Mode, Customer, Destination, End-User |

| Growth Drivers: |

|

| Pitfalls & Challenges: |

|

As international business activities flourish and globalization intensifies, the courier, express, and parcel services market is experiencing significant growth. The global expansion of businesses underscores the need for dependable and prompt parcel delivery services. These services are essential for managing international shipments, navigating customs intricacies, and ensuring smooth supply chain operations.

With increased trade and investment across borders, there is a pressing demand for sophisticated CEP solutions. These solutions adeptly address varied logistical challenges and accelerate delivery times. In response to this burgeoning demand, CEP companies are strengthening their global networks and infrastructure, driving both service enhancement and geographic expansion in the market.

Rising fuel prices significantly challenge the courier, express, and parcel (CEP) services market by increasing operational costs, thereby impacting profitability and pricing strategies. Labor shortages further strain the sector, causing delays and reducing service quality as companies struggle to hire and retain skilled workers. Additionally, the need for advanced technologies, such as automated sorting systems and real-time tracking, requires substantial investment. While these technological upgrades are essential for maintaining competitiveness, they can be financially burdensome, particularly for smaller operators. Collectively, these factors hinder efficient operations and market growth, compelling companies to innovate and manage costs effectively.

Courier, Express and Parcel Services Market Trends

Courier, express and parcel services are witnessing significant technological advancements in the adoption of AI and robotics. These advancements are significantly driving growth in the courier, express, and parcel (CEP) services industry by enhancing operational efficiency and accuracy. AI improves route optimization, predictive analytics, and customer service through chatbots and automated responses, leading to faster and more reliable deliveries.

Robotics streamline sorting and handling processes, reducing manual labor and errors while increasing throughput. These technologies also enable real-time tracking and autonomous vehicles, further enhancing service speed and customer satisfaction. By integrating AI and robotics, CEP companies can lower operational costs, handle higher volumes, and adapt quickly to evolving market demands, thereby fueling market expansion.

For instance, in June 2024, Evri, the UK’s largest dedicated parcel delivery company, announced a significant investment of £1 million in artificial intelligence (AI) aimed at enhancing customer service, improving parcel security, and optimizing workforce productivity. This initiative is part of a broader strategy to leverage AI for smarter data usage and operational efficiency. AI tools were utilized to analyze delivery data and photos, enhancing the ability to verify safe delivery locations and detect potentially fraudulent claims.

Courier, Express and Parcel Services Market Analysis

Based on the transportation mode, the market is segmented into roadways, railways, airways, and waterways. In 2023, the roadways segment accounted for a market share of over 63% and is expected to exceed USD 517.6 billion by 2032. Roadways dominate the courier, express, and parcel (CEP) services market due to their extensive infrastructure and flexibility. A vast network of highways and local roads enables road transportation to provide cost-effective and timely deliveries for both short and long distances. This mode supports essential door-to-door services, catering seamlessly to urban and rural needs.

Roadways can handle diverse package sizes and types with less regulatory complexity than air or sea transport, making them a preferred choice. Additionally, the rise of e-commerce has increased demand for last-mile delivery solutions, where road transportation excels in offering frequent, reliable, and cost-effective options. Such versatility and efficiency are pivotal to its leading market position.

Based on the destination, the courier, express, and parcel services market is divided into domestic and international. The domestic segment held around 77% market share in 2023, due to its efficiency and cost-effectiveness. Local deliveries benefit from shorter transit times, reducing transportation costs and avoiding the complexities of customs and international regulations. Well-established domestic logistics networks further enhance service speed and reliability.

The rise of e-commerce has increased domestic demand, as consumers now expect rapid deliveries for online orders. Additionally, businesses prefer domestic services for quick inventory restocking and customer order fulfillment. This combination of logistical simplicity and growing demand for prompt service solidifies domestic segmentation’s leading position in the market.

North America region accounted for a courier, express, and parcel services market share of over 33% in 2023 and is expected to exceed USD 266.2 billion by 2032, driven by significant e-commerce growth, advanced logistics infrastructure, and strong consumer demand for fast delivery.

The United States dominates the region with a substantial share due to its extensive and efficient transport network, large consumer base, and numerous delivery options. Further, Canada and Mexico contribute to market growth by expanding e-commerce sectors. Companies in this region focus on innovation and technology to enhance delivery speed and efficiency, further boosting market dynamics.

Moreover, Europe’s courier, express, and parcel (CEP) services market is highly developed, driven by robust e-commerce growth, advanced logistics infrastructure, and significant cross-border trade. Major markets include Germany, France, the UK, and Italy which benefit from well-established transport networks and a high demand for fast, reliable delivery services. The rise in online shopping and the need for efficient supply chain solutions continue to propel market growth. Additionally, Europe’s emphasis on sustainability is influencing logistics practices, leading to increased investment in eco-friendly delivery solutions.

Furthermore, the CEP services market in the Asia-Pacific region is growing rapidly, driven by the expanding e-commerce sector, increasing disposable incomes, and rising urbanization. China and India are key drivers, with high demand for both domestic and cross-border deliveries. The region benefits from advanced logistics infrastructure and technological innovations. Additionally, the growing middle-class population and improved internet penetration contribute to rising parcel volumes. However, challenges include diverse regulatory environments and infrastructure disparities across countries. Overall, the Asia-Pacific region is a crucial growth opportunity hub for the market.

In Latin America, the growth of the courier, express, and parcel (CEP) market is driven by expanding e-commerce and improved logistics infrastructure, with Brazil and Argentina as key players. In the Middle East and Africa (MEA) region, increasing international shipping demand and the development of logistics hubs, particularly in GCC countries and South Africa, are fueling growth. Both regions are experiencing rising consumer demand for faster and more reliable delivery services amid evolving economic conditions.

Courier, Express and Parcel Services Market Share

United Parcel Service (UPS), FedEx Corporation, and DHL Express held a significant market share of over 17% in 2023. UPS is expanding its global network, optimizing routes through technology, and improving last-mile delivery. Committed to sustainability, UPS is investing in electric vehicles and renewable energy. The company further provides tailored services for e-commerce, healthcare, and small enterprises.

FedEx is undergoing a digital transformation, harnessing AI and analytics to boost operational efficiency. The company is broadening its e-commerce services, pouring resources into autonomous delivery innovations, and championing sustainability efforts, including carbon-neutral shipping. Furthermore, FedEx is bolstering its cross-border trade services to facilitate global commerce.

DHL Express is fortifying its global presence, especially in emerging markets, with an emphasis on speed and reliability. The company is investing in green logistics, aiming for zero emissions by 2050. Additionally, DHL is prioritizing digitalization and automation to elevate customer experience and streamline operations.

Courier, Express and Parcel Services Market Companies

Major players operating in the courier, express and parcel services industry are:

- United Parcel Service (UPS)

- FedEx Corporation

- DHL Express

- DB Schenker

- Japan Post Group

- La Poste Group

- Royal Mail Group

- GLS Group

- Aramex

- Blue Dart Express

Courier, Express and Parcel Services Industry News

- In August 2024, Indonesia’s J&T Express officially launched its parcel delivery service in Saudi Arabia, marking a significant expansion into the Middle Eastern logistics market. The new service, named J&T SPEED, aims to provide efficient and reliable delivery solutions for both businesses and individual customers across the Kingdom. The launch of J&T SPEED is part of the company’s broader strategy to leverage its international expertise and cater to the evolving logistics needs in Saudi Arabia, where e-commerce is rapidly growing.

- In July 2024, The Uttar Pradesh State Transport Corporation (UPSRTC) announced plans to launch courier and parcel delivery services starting in September 2024. This initiative aims to utilize approximately 11,000 buses, which include both air-conditioned and ordinary vehicles. The service is being introduced in collaboration with AVG Logistics Limited, and the necessary infrastructure is expected to be operational by September 9, 2024.

The courier, express and parcel services market research report includes in-depth coverage of the industry with estimates & forecasts in terms of revenue (USD Billion) and volume (units) from 2021 to 2032, for the following segments:

Click here to Buy Section of this Report

Market, By Service

- Courier services

- Express services

- Parcel services

Market, By Transportation Mode

- Roadways

- Railways

- Airways

- Waterways

Market, By Customer

Market, By Destination

Market, By End-User Industry

- E-commerce

- Retail

- Manufacturing

- Healthcare

- Financial Services

- IT and Telecommunications

- Others

The above information is provided for the following regions and countries:

- North America

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Nordics

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- ANZ

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- MEA

- UAE

- Saudi Arabia

- South Africa

- Rest of MEA

link